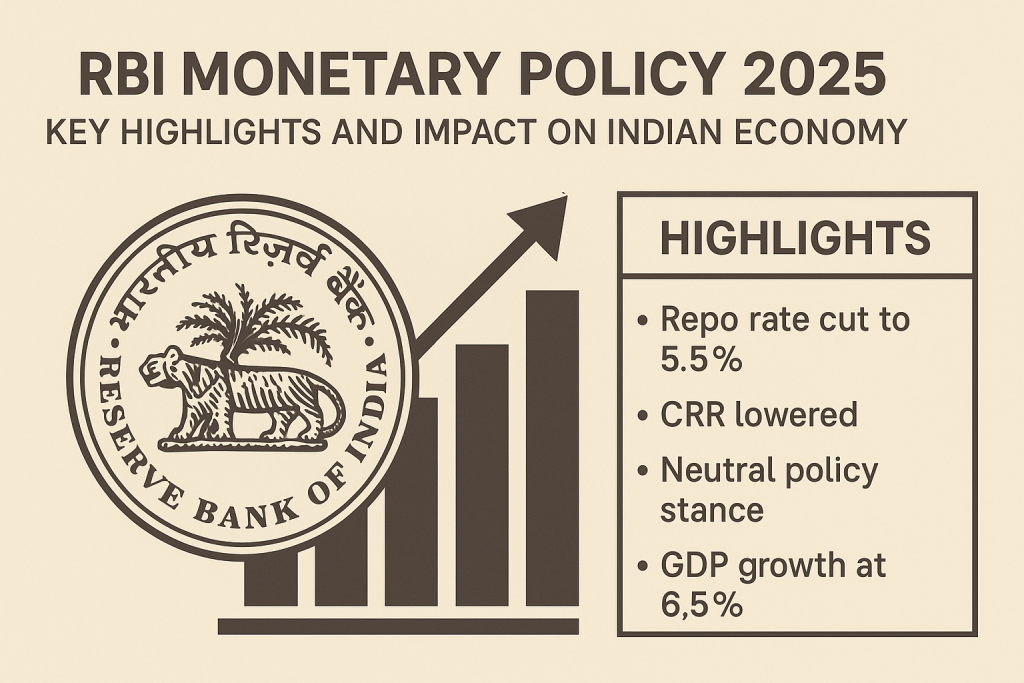

RBI Monetary Policy 2025: Key Highlights and Impact on Indian Economy

The RBI Monetary Policy 2025 took a pivotal turn on , when the Reserve Bank of India cut the repo rate by 50 bps to 5.50 %. This bold move aims to stimulate growth and support borrowing amid slowing economic momentum.

📌 Key Highlights of the June 2025 Policy

- Repo rate cut: Reduced from 6.0% to 5.5%, three consecutive cuts since February—total easing of 100 bps in 2025.

- Cash Reserve Ratio (CRR): Lowered by 100 bps to 3%, to inject ₹2.5 trillion liquidity by year-end.

- Policy stance: Shifted from “accommodative” to “neutral”.

- Inflation & growth outlook: CPI inflation near six-year low (~3.2%), GDP forecast steady at 6.5% for FY26.

🏦 Immediate Impact

Borrowers can expect EMI reductions on home and personal loans following repo-linked lending rate cuts. For example, a ₹1 crore home loan EMI may drop to ~₹68,000.

📊 Market & Banking Effects

- Banks: Major PSBs (PNB, BoB, Indian Bank, BOI) immediately passed on rate cuts.

- Markets: Equities rallied as a result of the “jumbo” rate cut and CRR reduction.

- FD rates: Deposit rates at ICICI Bank and others were lowered—now 4–6.6% for general, 3.5–7.1% for senior citizens.

💡 Implications for the Economy

- Borrowers: Lower EMIs — greater affordability for home, personal, and MSME loans.

- Savers: FD returns decline, prompting investors to reassess portfolios.

- Businesses: Improved liquidity and lower borrowing costs likely to boost capex & consumption.

- Inflation control: RBI’s neutral stance suggests caution in further easing, mindful of inflation risks.

Related Reads

- Understanding Repo Rate and Its Economic Impact

- RBI’s official June 2025 Monetary Policy press release

Conclusion

The RBI Monetary Policy 2025 marks a significant shift toward growth with a bold 50 bps repo cut and CRR reduction, aiming to energize lending & consumption. While savers may feel the pressure, borrowers and businesses stand to benefit. The bank’s neutral stance signals a pause—future moves will depend on inflation and growth data.