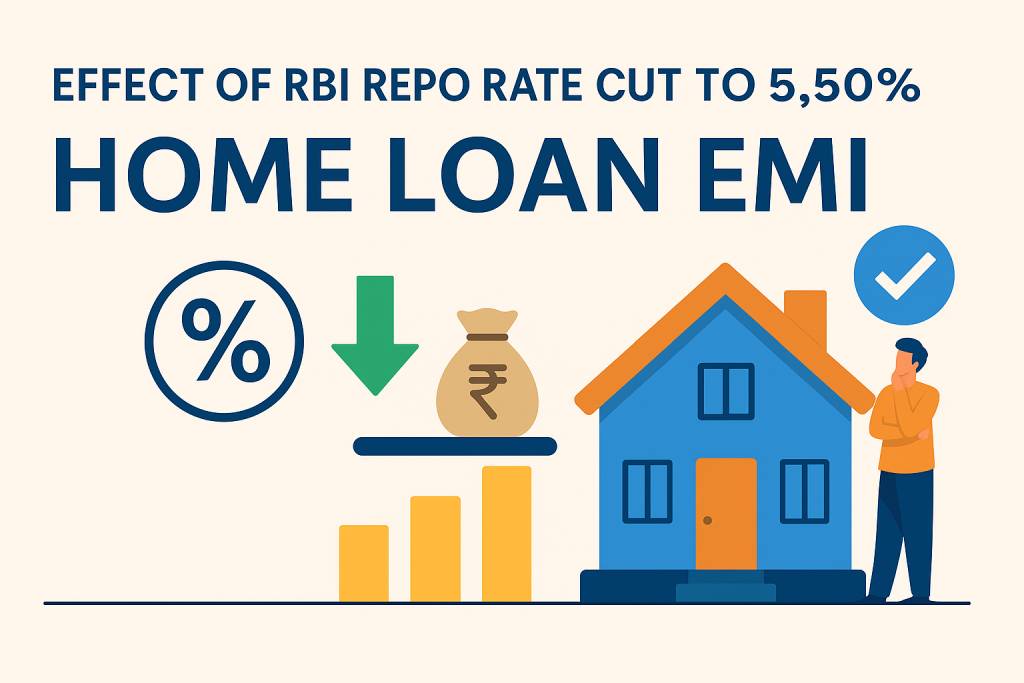

RBI Cuts Repo Rate to 5.50%: What It Means for Your Home Loan EMI

💡 What Is the Repo Rate?

The repo rate is the interest rate at which RBI lends money to commercial banks. A lower repo rate reduces borrowing costs for banks, which often leads to cheaper loans for customers across housing, auto, and education sectors.

📉 Impact of the 5.50% Repo Rate on Home Loan EMIs

- For a ₹50 lakh home loan over 20 years, you could save ₹2,500–₹3,500 per month in EMI.

- A ₹1 crore loan might offer monthly EMI relief of ₹5,000 or more.

- Many banks have already started reducing their interest rates.

🏠 What This Means for Homebuyers

This rate cut improves housing affordability in India. It helps by:

- Reducing EMI burden

- Improving loan eligibility

- Encouraging purchase decisions in affordable and metro housing markets

Use our free calculator app to check your updated EMI instantly:

SIP & Home Loan EMI Calculator

💰 Broader Economic Impact

- Auto and education loans: Expected to get cheaper

- FD interest rates: May slightly decline

- Stock market: Likely to benefit from increased liquidity

🧠 Should You Switch or Refinance Your Loan?

If your loan is linked to the old base rate or BPLR, consider switching to a repo-linked lending rate (RLLR). This ensures quicker benefits from rate changes.

Before switching, check:

- Processing fees or penalties

- Total interest cost over the new tenure

- EMI comparison using a trusted financial calculator app

🔮 What’s Next?

The RBI has adopted a neutral stance. Future changes will depend on inflation, industrial output, and global financial trends. Stay tuned for updates from the next policy meeting.

📲 Plan Better with Our App

The SIP & Home Loan EMI Calculator app helps you:

- Calculate and compare EMIs

- Visualize long-term savings

- Save and share results