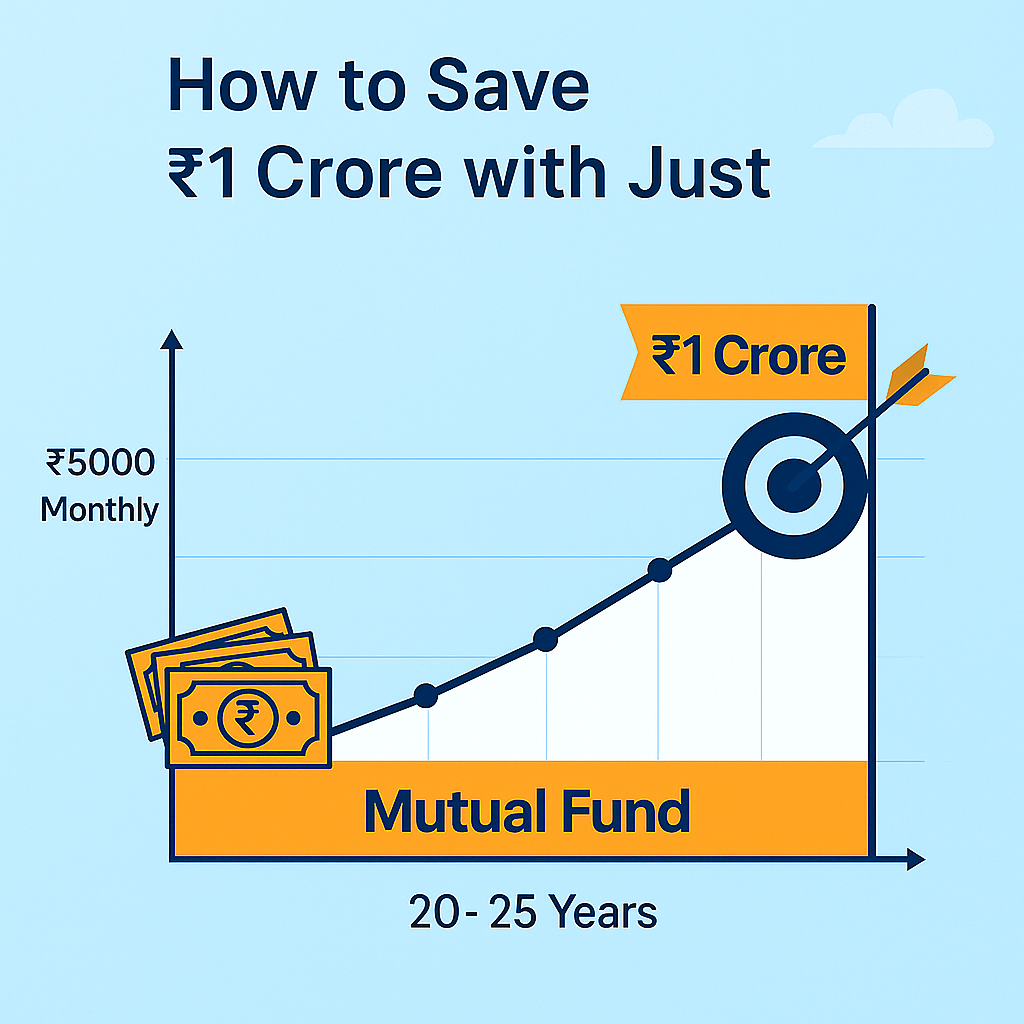

How to Save 1 Crore with Just ₹5000 Monthly SIP

Many people dream of becoming crorepatis, but few realize it can begin with just ₹5000 a month. Thanks to Systematic Investment Plans (SIPs), even small, consistent investments can help you save ₹1 crore with SIP over time.

✅ What is a SIP?A Systematic Investment Plan (SIP) lets you invest a fixed amount in mutual funds at regular intervals. It removes market timing stress and builds long-term wealth through disciplined investing. 🔢 The Math: ₹5000 Monthly SIP to ₹1 CroreAssuming a 12% annual return (based on equity mutual fund averages), here’s how much you could earn:

💡 Tip: The earlier you start, the more you benefit from compounding! 📈 Why SIP is the Best Way to Save ₹1 Crore

🧮 Try It YourselfUse the SIP & Home Loan EMI Calculator app to:

📲 Download the AppSimplify your wealth-building journey now: SIP & Home Loan EMI Calculator 🛑 Final Tips

|