This category covers all updates, analysis, and insights related to the Reserve Bank of India’s monetary policies. From repo rate changes to inflation control measures, understand how RBI’s decisions affect loans, savings, investments, and the broader Indian economy. Ideal for readers seeking financial clarity and timely information on policy developments that shape market trends and personal finances.

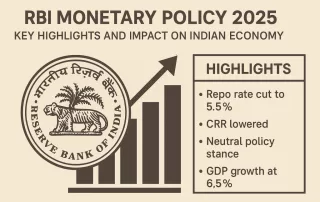

RBI Monetary Policy 2025: Key Highlights and Impact on Indian Economy

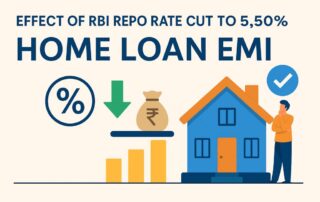

The RBI Monetary Policy 2025 took a pivotal turn on June 6, 2025, when the Reserve Bank of India cut the repo rate by 50 bps to 5.50 %. This bold move aims to stimulate growth and support borrowing amid slowing economic momentum. 📌 Key Highlights of the June 2025 Policy Repo rate cut: Reduced from 6.0% to 5.5%, three ...Read more